will capital gains tax increase be retroactive

Signed 2 January 2013. Hawaiis capital gains tax rate is 725.

Managing Tax Rate Uncertainty Russell Investments

Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income rates with 37.

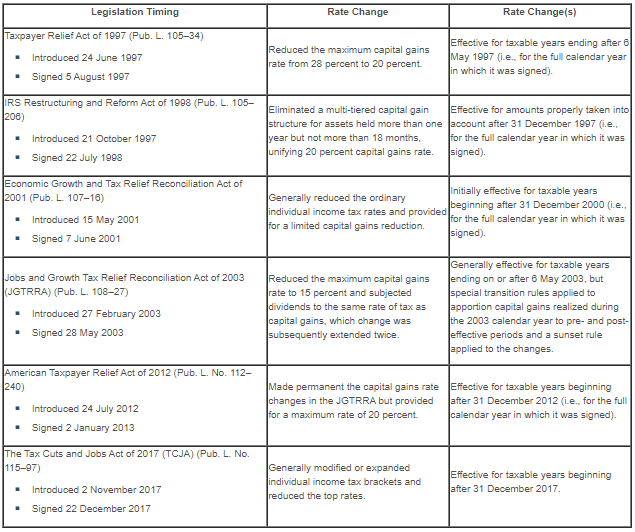

. Reduced the maximum capital gains rate from 28 percent to 20 percent. A Multimillion-Dollar Sale No. That applies to both long- and short-term capital gains.

With tax writers launching mark-ups as early as Sept. All may not be lost. 1 day agoReal estate capital gains tax deductions explained.

Made permanent the capital gains rate changes in the JGTRRA but provided for a maximum rate of 20 percent. Posted June 10 2021. 9 and racing against a Sept.

There is already some pushback among some congressional Democrats concerning the Presidents capital-gains tax plan. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. This news is not surprising but it rather buries the lede.

Bidens budget calls for the increase in the top capital gains rate to be implemented retroactively. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have been greater. The Democrats proposed tax deduction for the rich puts the Vermont socialist and low.

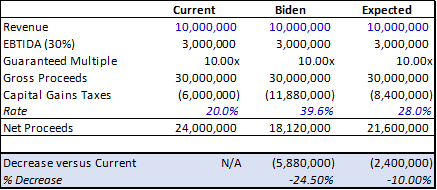

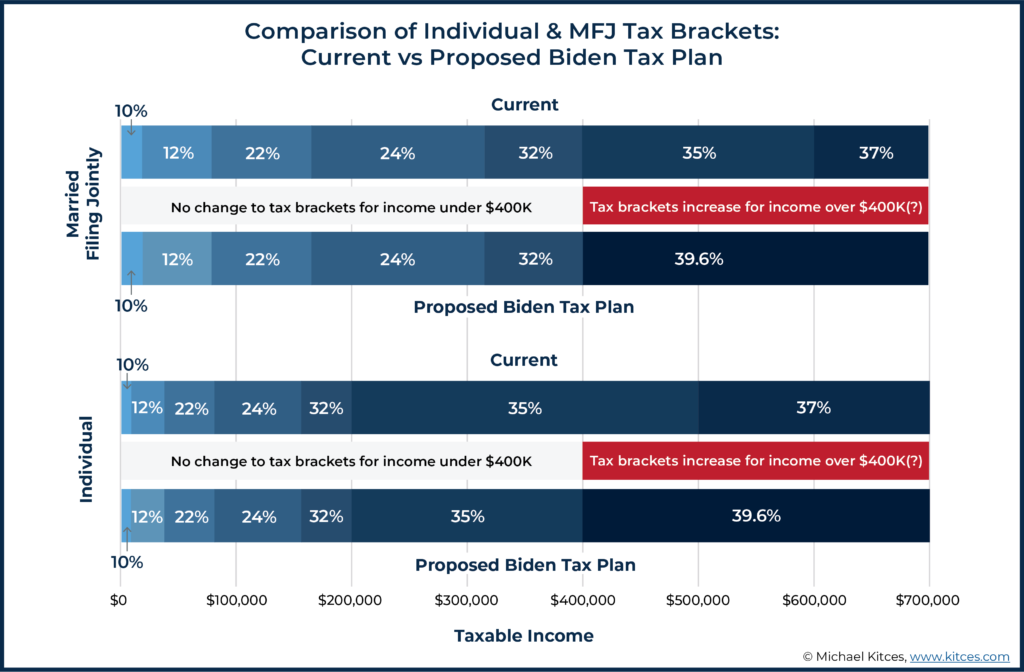

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains realized by taxpayers with income in excess of 1 million annually. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the.

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. What caught most everyone off guard is the. 27 deadline there could be imminent action triggering an effective.

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. In order to pay for the sweeping spending plan the president called for nearly doubling the capital gains tax rate to 396.

BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B. The rationale behind a retroactive tax hike is that it prevents the rich from taking preventative measures to protect their assets. Signed 5 August 1997.

All the US tax information you need every week. At this point though its looking like the. Lets remember that Congress must still approve any changes in tax rates as well as any retroactive effective dates.

American Taxpayer Relief Act of 2012 Pub. The top rate for 2021 is 37 plus. Effective for taxable years beginning after 31 December 2012 ie for the full calendar year in which it was signed.

Tax avoidance most of it legal would cut about 900 billion of the estimated 1 trillion that a capital gains tax increase could generate for the federal government over the next decade the researchers said. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

Effective for taxable years ending after 6 May 1997 ie for the full calendar year in. Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238.

There is currently a bill that if passed would increase the. Top earners may pay up to 434 on long-term. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at.

The deduction you receive when selling your principal residence is as follows. 112240 Introduced 24 July 2012. A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes.

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Are Taxes Going Up Mission Wealth

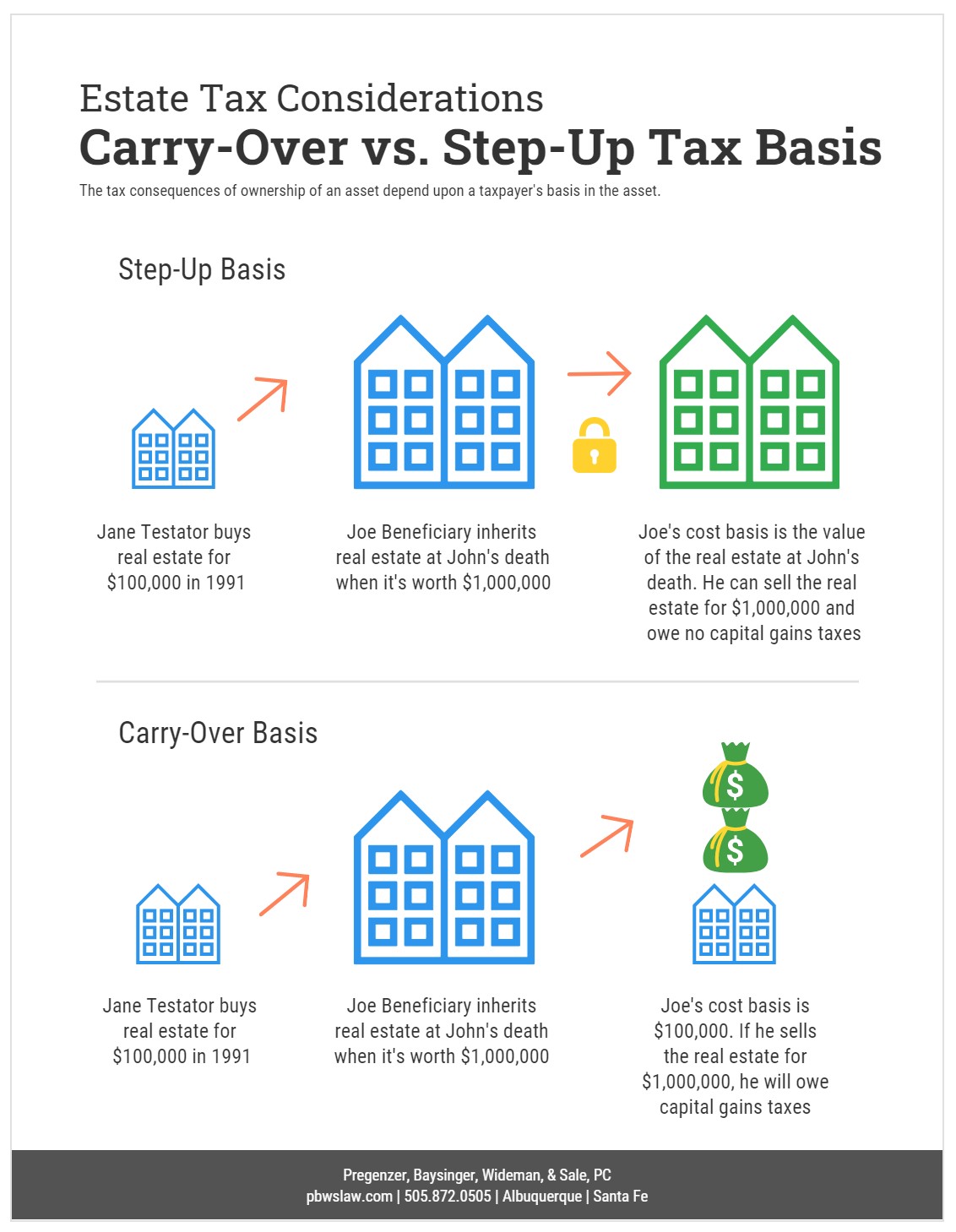

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

Estate Taxes Under Biden Administration May See Changes

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

A Retroactive Tax Increase Wsj

What Can The Wealthy Do About Biden S Proposed Tax Increases

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Biden Tax Plan And 2020 Year End Planning Opportunities

Biden S Proposed Retroactive Capital Gains Tax Increase

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

If The Build Back Better Bill Does Pass In 2022 Will The Capital Gains Qsbs Changes Still Be Retroactive To 2021 R Fatfire

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra