kansas sales tax exemption application

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. KANSAS SALES AND USE TAX REFUND APPLICATION.

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Complete this application using the instructions that begin on page 3.

. Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. He earned his law degree in 1979 from the. Harbor Compliance can obtain Kansas sales tax exemption for your 501c3 nonprofit.

Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts. If you are applying for a property tax exemption pursuant to the following statutes you must attach a completed. Kansas law KSA 40-252d provides for a tax credit for insurance companies equal to 15 percent of Kansas-based employees salaries or up to a maximum of 1125 percent of taxable premiums.

Ks Sales Tax Exemption Certificate Simple Online Application. _____ Applicant Name Owner of Record. A sales tax exemption that will be.

There are three parts to your Kansas Sales Tax Account Number. Kansas Sales And Use Tax Entity Exemption Certificate. Complete a Kansas Business Tax Application.

Kansas retailers should follow this. Tax Exemption Application Page. For additional information on Kansas sales and use taxes see Publication KS-1510 Kansas Sales Tax and Compensating Use Tax and Publication KS-1520 Kansas Exemption Certificates.

Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. If you are accessing our site for the first time. How to apply for Kansas sales tax exemption.

800 524-1620 Sales Tax Application Organization. Ad Register and Subscribe Now to work on KS Exemption Certificates more fillable forms. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms. Be either a manufacturer or able to document that most of its sales are to Kansas manufacturers andor out-of-state businesses or government agencies. Current Format of Sales Tax Account Numbers A Kansas Sales tax account number is a fifteen-character number.

Save Time Signing Documents from Any Device. Ad Ks Sales Tax Exemption Certificate Wholesale License Reseller Permit Businesses Registration. Register for a Kansas Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form.

Ad Fill out a simple online application now and receive yours in under 5 days. 1320 Research Park Drive Manhattan Kansas 66502 785 564-6700 The information contained in this handbook is for informational purposes only and is to be used as a resource. TX Application Form pdf Additions to Property Tax Exemption Application.

While the Kansas sales tax of 65 applies to most transactions there are certain items that may be exempt from taxation. Kansas Application for Sales Tax Exemption Certificates KS-1528 Kansas Exemption Booklet KS-1520 This publication assists businesses to properly use Kansas Sales and. BEFORE THE BOARD OF TAX APPEALS OF THE STATE OF KANSAS TAX EXEMPTION KSA.

Ad Ks Sales Tax Exemption Certificate Wholesale License Reseller Permit Businesses Registration. Complete Edit or Print Tax Forms Instantly. Entries are required on all fields marked with an asterisk.

The format of this sample can be used to create legally valid exemption certificates to be filed with a seller at the time of a purchase. This page discusses various sales tax exemptions in Kansas. This permit will furnish your business with a unique sales tax number.

The certificates will need. Your Kansas sales tax account number has three distinct parts. Therefore you can complete the resale exemption certificate form by providing your Kansas Sales Tax Registration Number.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. Entries are required on all fields marked with an asterisk. Application for Tax Exemption Kansas retailers are responsible for collecting the full amount of sales tax due on each sale to the final user or consumer.

Ks Sales Tax Exemption Certificate Simple Online Application. How to use sales tax exemption certificates in Kansas.

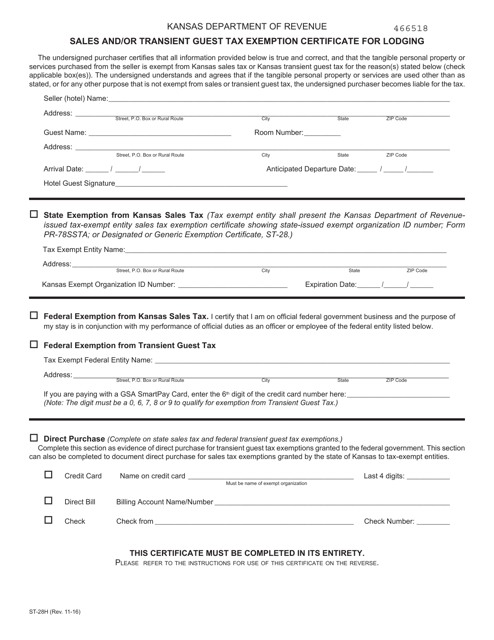

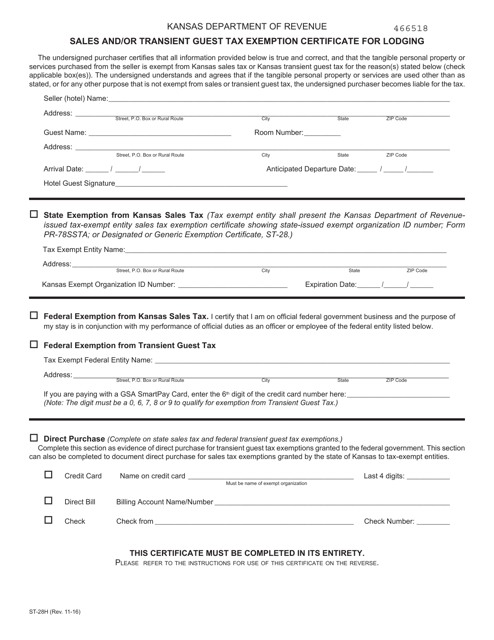

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Form Pec Entities Fillable Sales And Use Tax Refund Application For Use By Project Exemption Certificate

Fillable Online Baldwincity Kansas Department Of Revenue Baldwincityorg Fax Email Print Pdffiller

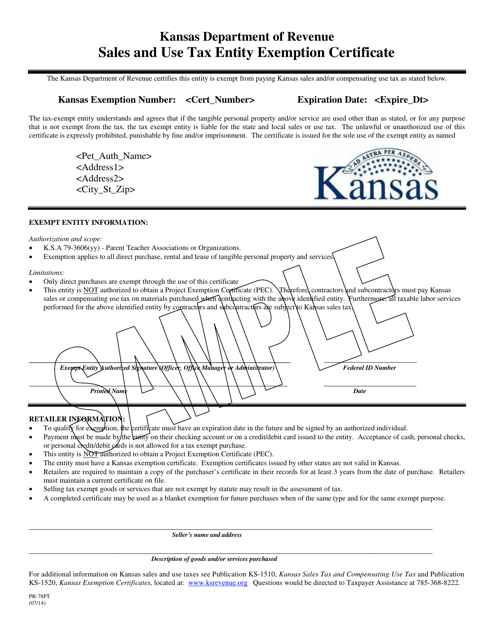

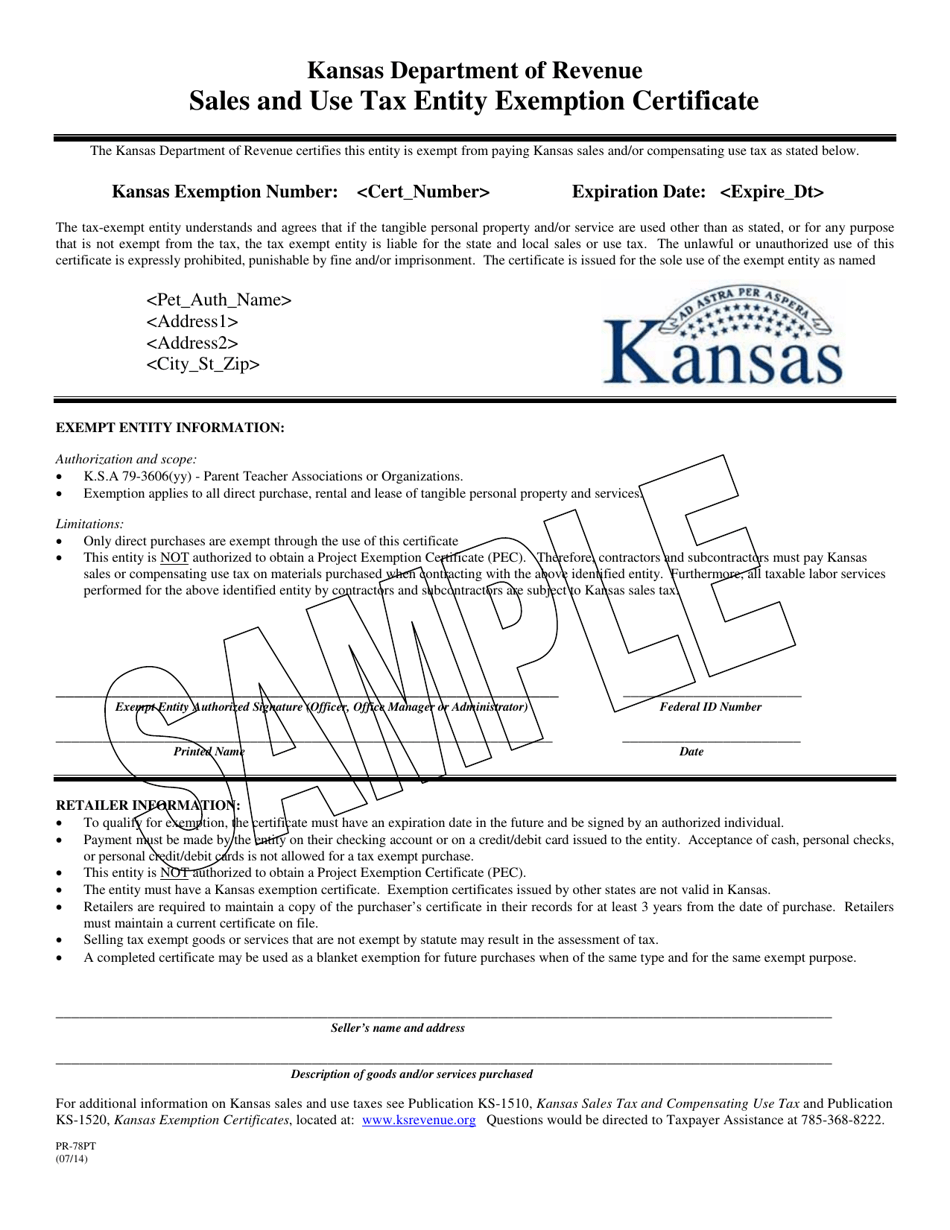

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Kansas Resale Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Form St 8b Fillable Affidavit Of Delivery Of A Motor Vehicle Semitrailer Pole Trailer Or Aircraft To A Nonresident Of Kansas

Pr 78 Fill Online Printable Fillable Blank Pdffiller

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller